Cryptocurrency Withdrawal

- Choose Deposit option and copy the cryptocurrency address or use a QR code scanner. The deposit will be added to your account after receiving the right amount of the confirmations from the network. To make a withdrawal, while in 'Wallet' tab, after selecting the appropriate currency, select Withdrawal. Enter the recipient's address and the.

- This fee goes to cryptocurrency miners, not Coinbase, as an incentive to secure the network and include your transaction on the blockchain. There are a number of network-dependent factors that are used to calculate a withdrawal fee, making it difficult to predict these fees before attempting to withdraw.

- A withdrawal from the Crypto.com Exchange is an on-chain transaction of transferring crypto to an external cryptocurrency address (usually a wallet or another exchange). As with all blockchain transactions, they come with a fee. Note: Transferring crypto to your Crypto.com Wallet App's address will also incur a fee if completed on-chain.

- You can withdraw cryptocurrencies to any valid address for the relevant cryptocurrency by visiting your Withdrawal page. The withdrawals interface allows users to monitor the current Tx Fee in relation to cryptocurrency withdrawals. At any time, you may visit the fees page to monitor current transaction fees for withdrawals.

Making cryptocurrency payments more convenient has not been an easy task for many companies. Consumers often face challenges while trying to find platforms that accept payments in the form of digital currencies. Shop owners still do not see the benefit of such payments. However, Coinbase has developed a brilliant solution to this problem. Below is the method to withdraw cryptocurrency to PayPal.

Started With Coinbase

Coinbase—an American based cryptocurrency exchange platform has grown in popularity thanks to its various services. As regards to daily trading volume, this exchange remains among the leading exchange platforms, with a $160 million on average.

Coinbase was launched by Brian Armstrong and Fred Ehrsman about 7 years ago and boasts a friendly user interface. Newbies in the crypto industry can exchange different currencies at ease on the platform. Furthermore, users enjoy a safety guarantee alongside minimal trading charges.

Additionally, the platform has always strived to set itself apart from other exchanges by making crypto transactions extremely easy. Coinbase users can easily withdraw funds from the platform and transfer the same into their bank accounts within days. And now, Coinbase has added more features to cut this waiting period from days to minutes.

The popular cryptocurrency exchange platform allows you to withdraw cash directly into your PayPal account. Thanks to this, users can use the Instant Transfer feature using their debit cards to receive their funds instantly for a small fee of $0.25, which is much better and more convenient compared to withdrawing cash from your Coinbase wallet into your bank account.

Just to confirm, this feature does not allow you to purchase any cryptocurrency from your PayPal account. Hopefully, this will be available soon, but at present, you can only withdraw funds into your PayPal, which is still great!

Withdrawal Fees. On Cryptocurrency Exchanges. Coins (2208) Exchanges (56) L2 is here: the self-custody and no KYC of a DEX, instant and cheap trades like a CEX.

Before we move into withdrawing into your PayPal account, let’s first understand how to add your PayPal account to Coinbase.

Adding Your PayPal Account To Coinbase

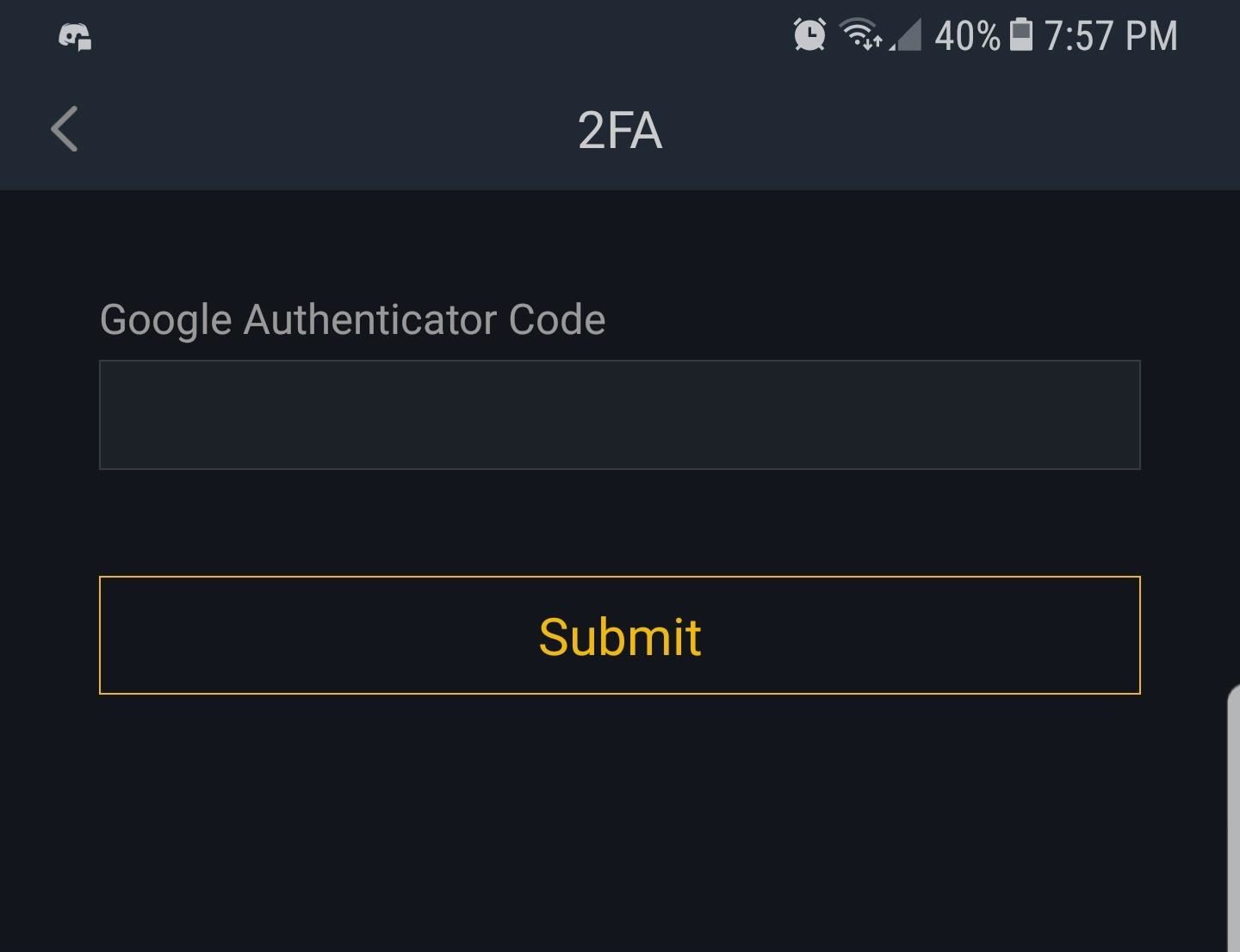

Before adding your PayPal account to Coinbase, you have to log in. You can use a browser on your smartphone or computer. And you can only perform this transaction from your Coinbase wallet.

After accessing your Coinbase wallet through your browser, log into your wallet. Once you’ve logged in, go to “Settings”, this is found at the top of the window.

While in the settings, click “Linked Accounts”, you’ll find this at the top tab, then click, “Link a New Account” to move forward.

From there, you’ll see a list of account options that will pop up, click “PayPal”. After this step, you’ll be redirected to the login page of PayPal. Log in using your email and password.

Once you’re in your PayPal account, you’ll be directed to a confirmation page where PayPal will ask you to allow Coinbase access to money transfers—click “Agree” to link both accounts.

After successfully linking your PayPal to your Coinbase account, go back to your Coinbase account.

You can now withdraw funds from Coinbase to PayPal very easily.

How To Withdraw Cryptocurrency To PayPal

To withdraw funds from Coinbase to PayPal, select the “Buy/Sell” option on the Coinbase toolbar (on the right Dashboard), and select “Sell”. On the “Sell From” section, select the wallet you want to transfer the funds from, and select your PayPal wallet in the “Deposit To” section.

The next step is verifying the transaction details. Additionally, if you want to see the payment details further, click on the “Account” section from the toolbar. ‘From here, you can see the total amount of money transacted. You will then click “Confirm Sell” option.

If all the systems are right, the funds will reflect in your PayPal account instantly or after a few seconds.

From here, in case you want to transfer your PayPal funds into your bank account, just follow the instructions provided by PayPal.

The Instant Transfer feature provided by PayPal is available to U.S-based users and ensures that funds are transferred to one’s bank account in minutes, with a $0.25 fee for each transaction.

How To Remove Your PayPal Account From Coinbase

Cryptocurrency Withdrawal Fees

Unlinking your PayPal account from your Coinbase account is a lot easier compared to linking both accounts. This can be done through your Coinbase account.

To do so, just log into your Coinbase account, go to “Settings” at the bottom of the window, then click “Linked Accounts”.

From here, simply click the “Remove” button that is placed next to your PayPal account, then click “Remove” on the confirmation box that will pop up.

Major Concerns

PayPal has been on the spot for freezing users’ accounts at its whim and failing to follow regulations set by banks. This has seen the company receive many complaints from its users.

Additionally, the payment platform has one of the highest foreign exchange fees in the sector. For instance, the platform charges 5% for converting currencies. This means that it will cost you a whopping $50 to convert $1000!

Now we understand how the company made profits of $13 billion in 2017.

Apart from high foreign exchange fees, users are forced to wait up to a week to withdraw funds from PayPal into their bank accounts. Additionally, the company continues to increase its fees, which are often higher when compared to the transaction fees charged by most high street banks. As such, PayPal users may end up migrating to cryptocurrency transfers where the transaction is virtually instant and cheap.

Similarly, Coinbase seems to have joined PayPal in charging very high fees, as well as zealous account controls. As a result, many users have complained about the platform.

This exchange is among the most popular exchanges, thanks to its support for several cryptocurrencies, as well as its daily trading volume.

The integration with PayPal to allow users to withdraw funds is a major step for both platforms, and it proves that PayPal is finally warming up to cryptocurrencies. Nonetheless, there are many improvements that need to be made to ensure the process is perfect.

For instance, the platform should allow users to deposit funds to attract more users.

Cryptocurrency Withdrawal Tax

Conclusion

There is a ways to go before cryptocurrency is integrated with major payment systems around the world. However, there are ways for crypto users to move funds through PayPal as outlined above. As more adoption takes place, other financials institutions and services will likely allow for this as well.

Cryptocurrency Withdrawal Address

We hope the guide on How To Withdraw Cryptocurrency To PayPal has been helpful for you!